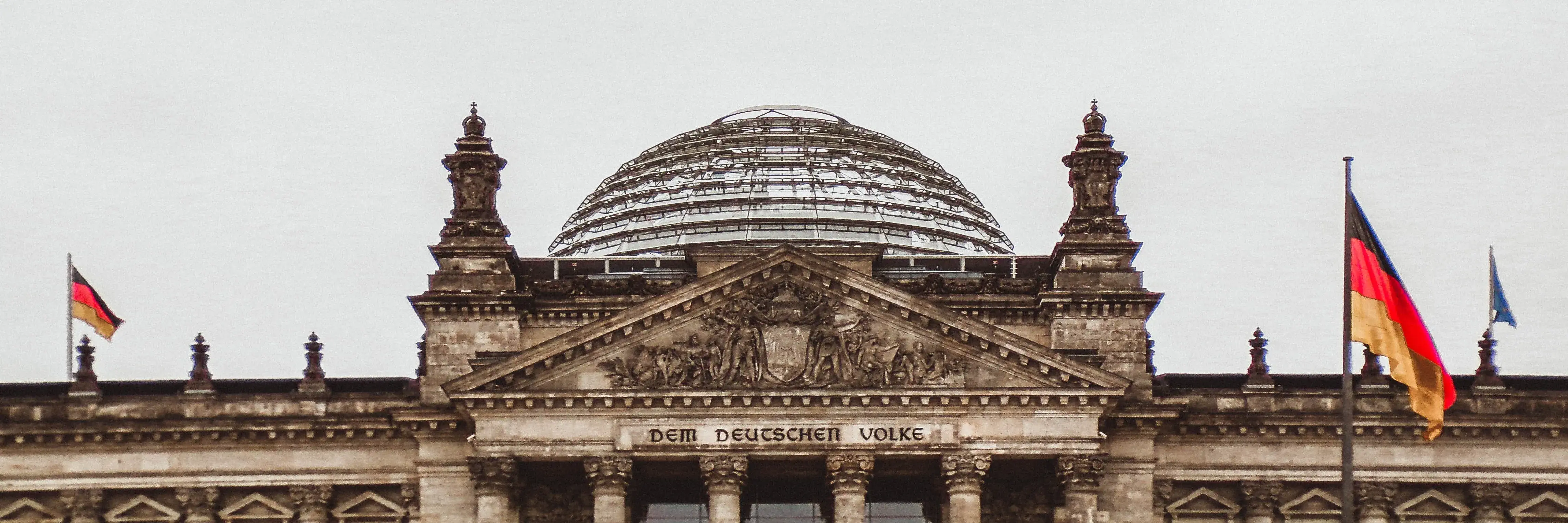

🇩🇪 Germany - Taxation Guide

Comprehensive Guide to Taxes in Germany 💰

Explore the different types of taxes in Germany and calculate your net salary with our German tax calculator. Understand income tax, social security contributions, and other applicable taxes.

German Tax Calculator 🧮

Use our tax calculator to estimate your income tax and understand the deductions applicable to your salary in Germany. Simply enter your details to get started.

Single

Compulsory Social Security Contributions in Germany 💸

Learn about the mandatory contributions deducted directly from your salary in Germany. Regular contributions to the social security system (Sozialversicherungssystem) provide support and security for residents, covering medical emergencies, unemployment, and more.

1️⃣ Health Insurance (Krankenversicherung)

- 14.6% of your gross salary split equally between you and your employer

- You can choose between private or public health insurance

- You can choose to take out a private health insurance if you are either self-employed or if you earn more than €64,350. If you choose to take out the private insurance, it will be harder to switch back to public insurance.

- Calculate your health insurance premium

2️⃣ Pension Insurance (Rentenversicherung)

- 18.7% of your salary split equally between you and your employer

- Your mandatory contributions will be used for your pension after retirement

3️⃣ Unemployment Insurance (Arbeitslosenversicherung)

- 2.4% of your gross salary split equally between you and your employer

- These mandatory contributions are used to provide unemployment benefits to anyone who is out of work.

4️⃣ Care Insurance (Pflegeversicherung)

- 3.05% of your salary split equally between you and your employer (plus 0.35% if you don't have children)

- Your mandatory contributions, which will be used if you need care due to old age

- Maximum contribution ceiling of €4,837.50 per month

Other Taxes in Germany 💰

Discover other taxes in Germany, including optional ones or those paid by yourself, such as church tax, TV and radio tax, car tax, and dog tax.

⛪ Church Tax (Kirchensteuer)

- 8% in Bayern and Baden-Württemberg & 9% in all other regions

- The percentage is calculated on top of your income tax

- Not all residents need to pay church tax; this depends on your faith

- You can choose to leave the church and avoid church tax

- More info on church tax

📺 TV and Radio Tax (Rundfunkbeitrag)

- €18.36 per household per month

- Students, disabled persons, etc., may receive a reduced or no fee

🚗 Car Tax (Kraftfahrzeugsteuer)

- Only if you own a car

- Depends on fuel type, engine type, registration year, emissions class, etc.

🐕 Dog Tax (Hundesteuer)

- €90 up to €150 per year per dog

- Only if you have a dog as a pet, not applicable to service animals

- Price for a second pet is higher