The Ultimate Guide to Expense Tracking: Master Your Finances

Expense tracking is not just a financial buzzword; it's an essential practice that empowers individuals and businesses to take control of their finances. Whether you're looking to create a budget, save more money, or simplify tax filing, expense tracking is the key. In this comprehensive guide, we'll explore everything you need to know about expense tracking, from methods and tools to tips and common mistakes.

1. What is Expense Tracking?

Expense tracking is the systematic process of recording, categorizing, and analyzing all financial transactions. It's more than just noting down numbers; it's about understanding where your money goes, identifying opportunities for savings, and ensuring financial accountability.

2. Why is Expense Tracking Important?

a. Budgeting

Tracking expenses helps you create a realistic budget, monitor adherence, and make necessary adjustments. It's the foundation of sound financial planning.

b. Financial Goals

Understanding your spending patterns enables you to set achievable financial goals, whether it's buying a home, starting a business, or planning a vacation.

c. Tax Purposes

Accurate expense tracking simplifies tax filing by providing clear records, potentially saving time and reducing errors. It's a must for businesses and freelancers.

3. Methods of Expense Tracking

a. Manual Tracking

Some prefer the hands-on approach of using a notebook or spreadsheet. It offers complete control but requires diligence.

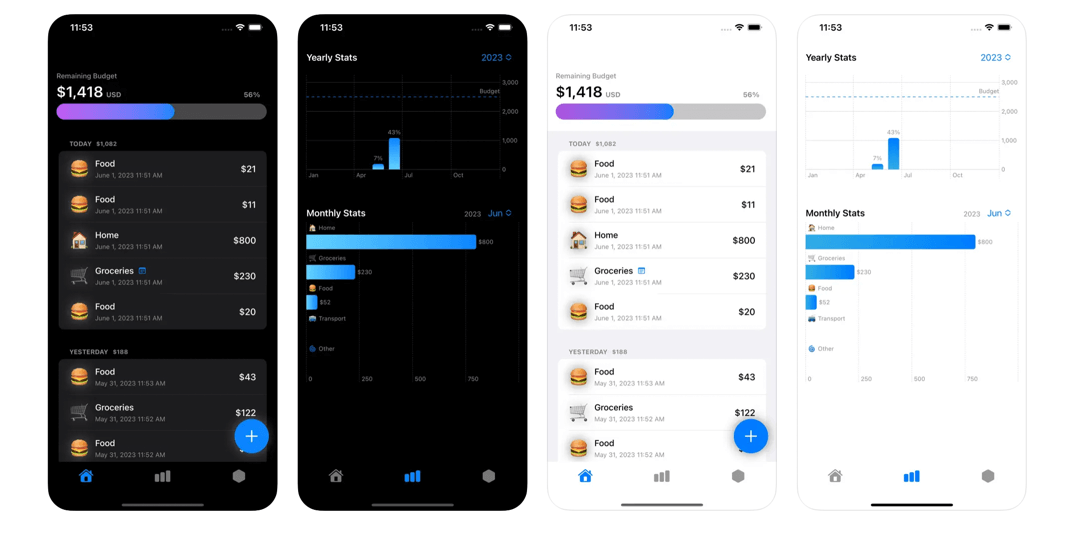

b. Expense Tracker Apps

Modern apps like ExTrak automate tracking, offering features like categorization, budgeting, and reporting. They make the process efficient and user-friendly.

c. Bank and Credit Card Statements

Regularly reviewing statements helps in understanding spending patterns and identifying areas for improvement. Most banks provide detailed insights.

4. Best Tools for Expense Tracking

a. Expense Tracker Apps

Apps provide automation and insights, making tracking effortless. They sync with bank accounts, categorize transactions, and offer visual reports.

b. Spreadsheets

Excel or Google Sheets offer customization for those who prefer a more hands-on approach. Here's a guide to creating your own expense tracking spreadsheet.

c. Financial Planners

Professional services provide personalized assistance, tailored strategies, and ongoing support. They're ideal for complex financial situations.

5. Tips for Effective Expense Tracking

- Stay Consistent: Regular recording ensures accuracy.

- Categorize Wisely: Clear categories help in understanding spending.

- Review Regularly: Regular analysis leads to informed decisions.

- Use Technology: Tools like Your App Name can automate the process.

6. How to Start Tracking Your Expenses

- Choose a Method: Decide between manual tracking, apps, or other tools.

- Set Clear Goals: Define what you want to achieve.

- Record Daily Transactions: Note every expense, no matter how small.

- Categorize Them: Use clear categories like 'Groceries,' 'Utilities,' etc.

- Review Regularly: Analyze data to make informed financial decisions.

7. Common Mistakes to Avoid

- Inconsistent Tracking: Missing entries lead to inaccurate data.

- Vague Categorization: Be specific to understand spending habits.

- Neglecting Regular Reviews: Regular analysis is key to success.

8. Conclusion

Expense tracking is a vital tool for financial success. With the right approach, tools like Your App Name, and diligence, you can gain control over your finances.